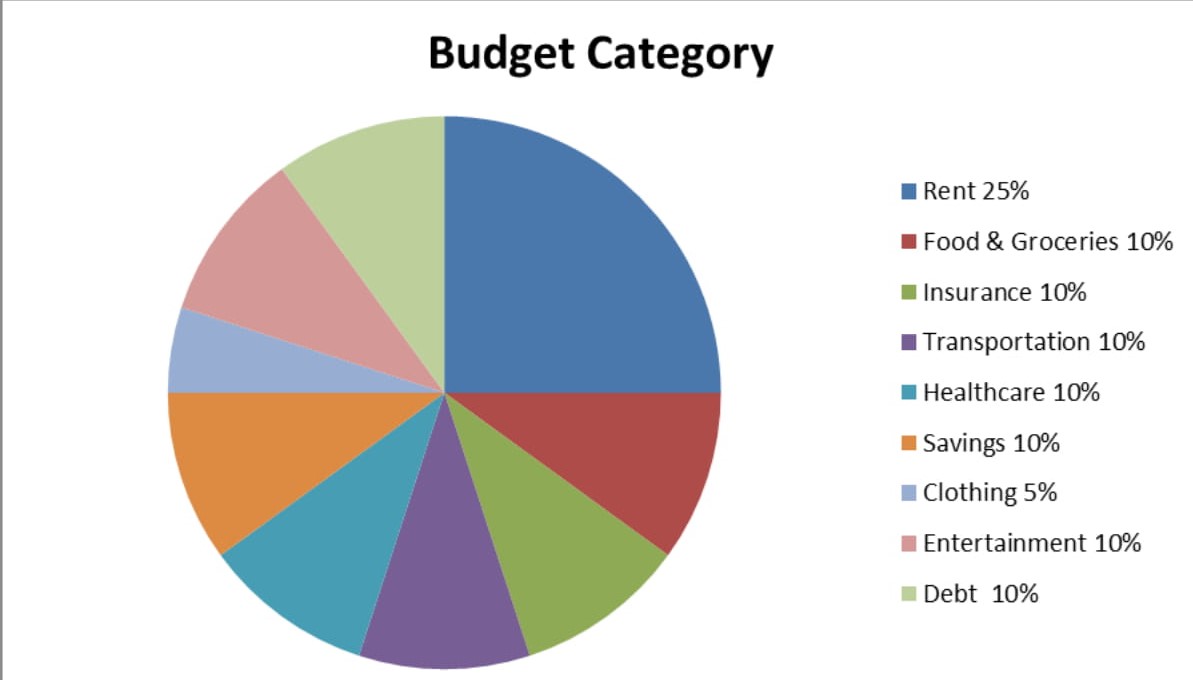

A personal budget is a tool to achieve personal financial goals. It is a financial plan that allocates personal income, expenses, debt repayment, and savings. The past income and expenses can be taken as a reference while creating the budget. Salary, rental income, and other income sources like interest income are consolidated under the head income. Bills and payments are the expenses. If you want to control your spending and work towards your financial goals, you need a budget.

A written, monthly budget allows you to plan your income sources and your savings and expenses. The main advantage is it allows you to track your spending habits. It helps you to identify how much is spent on each bill and whether you have spent more or less on it.